rhode island income tax rate 2020

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Both the state income and sales taxes are near national averages.

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

RHODE ISLAND TAX RATE SCHEDULE AND WORKSHEETS 2021 STANDARD.

. Your average tax rate is 1198 and your marginal tax rate is 22. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. DO NOT use to figure your Rhode Island tax.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Find your income exemptions. The average family pays 78800 in Rhode Island income taxes.

Rhode Island Income Tax Table Learn how marginal tax brackets work 2. 2020 The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum. Any income over 150550 would be.

The chart below breaks down the Rhode Island tax brackets using this model. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Rhode Island Income Tax Calculator How To. Rhode Island Tax Table.

Tax rate of 475 on taxable income between 68201 and 155050. The rate so set will be in effect for the calendar year 2020. Rhode Island also has a 700 percent corporate income tax rate.

Rhode Island Tax Brackets for Tax Year 2021. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Rhode Island Income Tax Table Learn how marginal tax brackets work 2.

A personal income tax is imposed for each taxable year which is the same as the taxable year for federal income tax purposes on the Rhode Island income of every individual. The average family pays 78800 in Rhode Island income taxes. Find your pretax deductions including 401K flexible account.

Rhode Island Corporate Income Tax Comparison A home business grossing. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 6525000 youll pay. The Rhode Island State Tax Tables below are a snapshot of the tax rates and thresholds in Rhode Island they are not an exhaustive list of all tax laws rates and legislation for the full list of tax.

Tax rate of 599 on taxable income over. Rhode Islands income tax brackets were last changed. Tax rate of 375 on the first 68200 of taxable income.

Rhode Island Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 375 0 to 65250 375 of Income 475 65250 to 148350 244688 475 599 148350. Rhode Island has a. The average effective property tax rate in Rhode Island is the 10th-highest in the country though.

Income tax rate schedule The Division of Taxation has posted the income tax rate schedule for 2021 that will be used by fiduciaries for many trusts and estates. Rhode Island reduced its corporate income tax rate for C corporations from 9 to 7 as of January 1 2015. Rhode Island Income Tax Calculator How To.

Effective January 1 2020 every applicable resident individual must maintain minimum essential health.

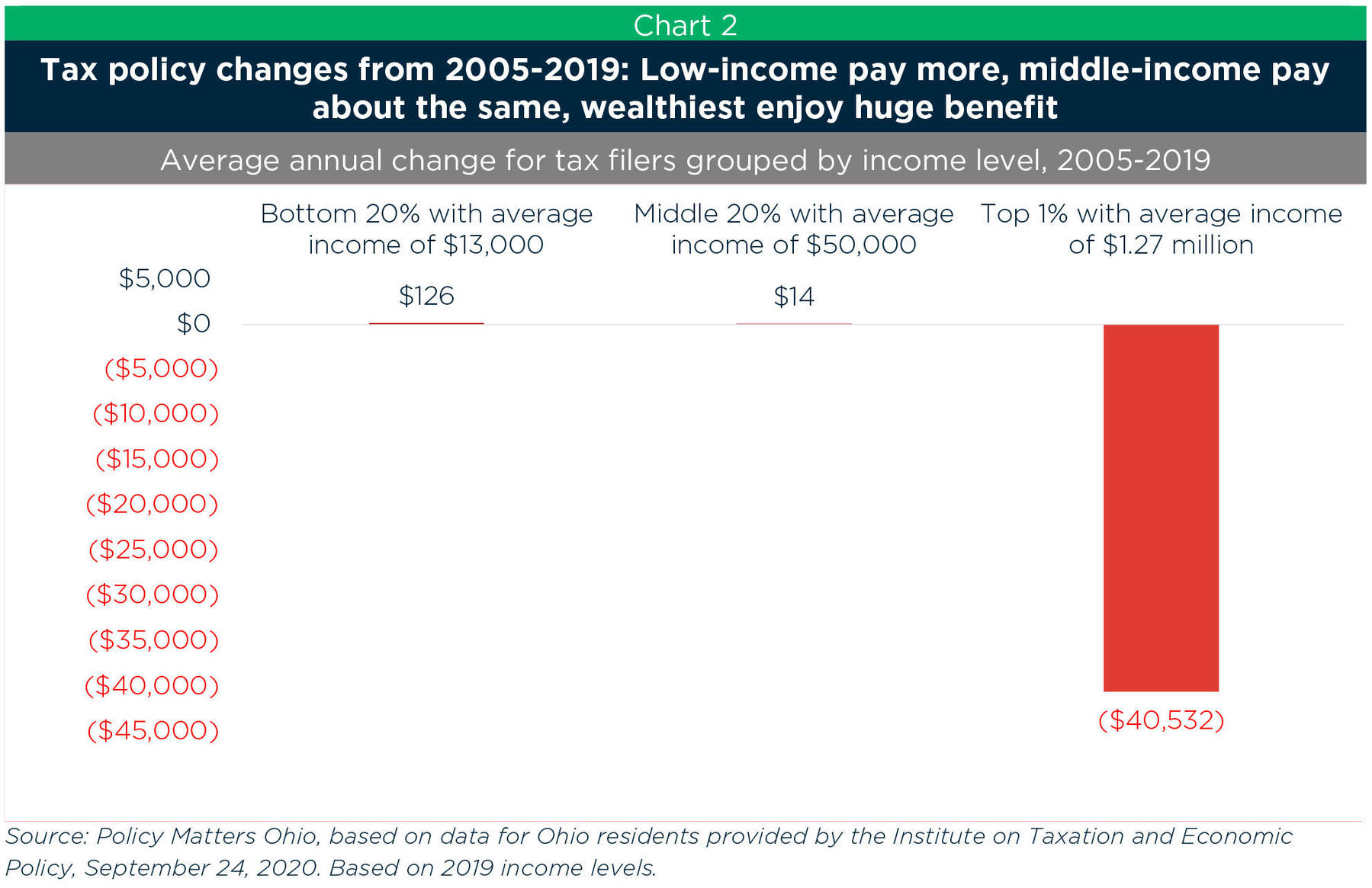

Rebalance The Income Tax To Build A Better Ohio For Everyone

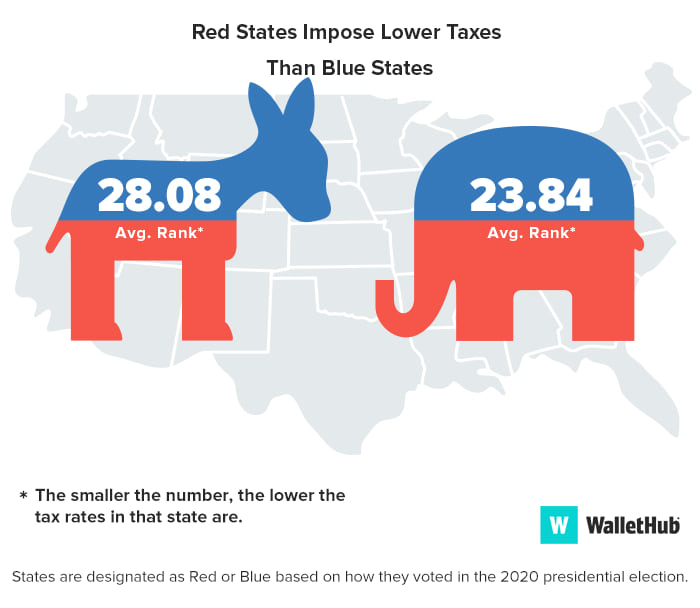

States With The Highest Lowest Tax Rates

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Rhode Island Income Tax Ri State Tax Calculator Community Tax

17 States With Estate Taxes Or Inheritance Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Individual Income Tax Structures In Selected States The Civic Federation

Rhode Island Income Tax Ri State Tax Calculator Community Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island Employers To See Flat Unemployment Insurance Taxes In 2022 Providence Business First

Rhode Island Key Performance Indicator Briefing For Q4 2021 Ri S Post Pandemic Economy Grows But Still Lags The Nation In Recovering Jobs Rhode Island Public Expenditure Council

Ri Health Insurance Mandate Healthsource Ri

States With The Highest Lowest Tax Rates

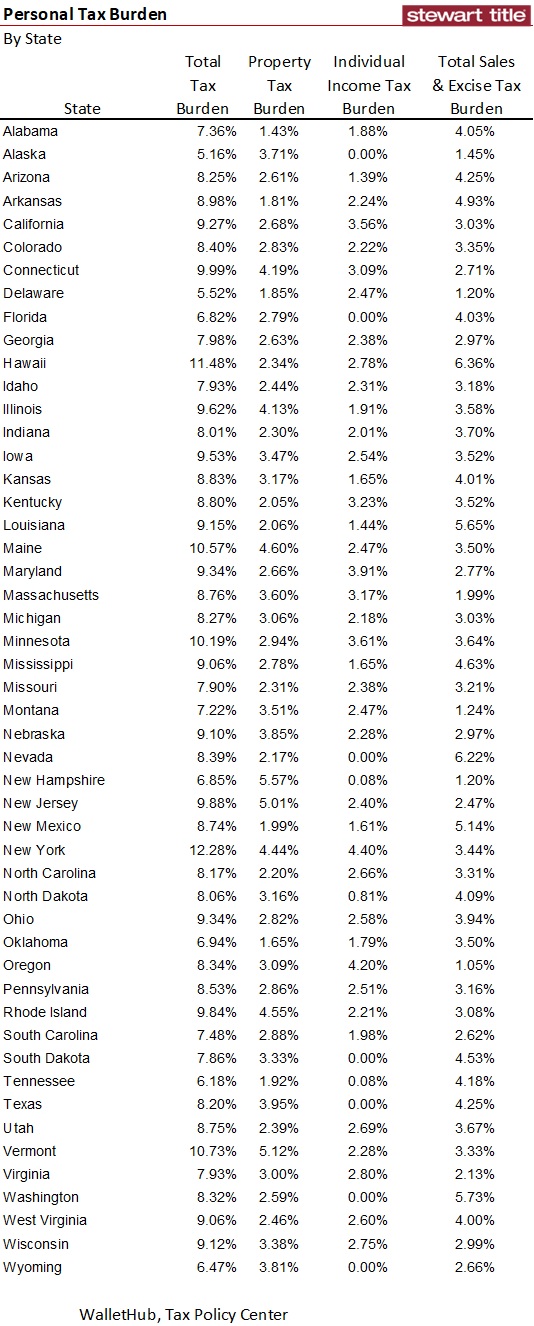

Another Top 10 List States With The Greatest And Least Personal Tax Burdens